This is a “sponsored post.” LightStream compensated FOF with an advertising

sponsorship to write it, and provides more information at LightStream.com. Regardless,

I only recommend products or services I believe will be helpful for our readers.

All insights and expressed opinions are my own. —Geri Brin

Ever since Hannah noticed the first sign of jowls on her face, she’s been thinking of having plastic surgery to get rid of them. She’s vowed for years that she would “grow old gracefully,” and never let a scalpel get near her, but she really hates those jowls and wants to see them go. They’re definitely not “graceful.”

Ever since Hannah noticed the first sign of jowls on her face, she’s been thinking of having plastic surgery to get rid of them. She’s vowed for years that she would “grow old gracefully,” and never let a scalpel get near her, but she really hates those jowls and wants to see them go. They’re definitely not “graceful.”

Hannah isn’t alone. Women had over 15 million minimally invasive and invasive cosmetic surgery procedures in 2013, a 3 percent increase over 2012, according to research from the American Society of Plastic Surgery. Among the top treatments were liposuction (over 350,000 procedures); tummy tucks (over 150,000 procedures); eyelid lifts (over 150,000 procedures.) Smart, active, dynamic women today really aren’t interested in looking 30 again; they simply want to look the best they can for their ages.

Sure, more and more skin creams and serums, as well as nutritional supplements, are being created with ingredients that truly stimulate collagen production. And non-invasive treatments, such as laser resurfacing, can help give our skin a more youthful look.

Yet, nothing at all has yet been developed to take the place of nips and tucks. And masterful board certified plastic surgeons are giving women (some even in their late 70s and 80s) natural looks. Really natural looks!

Hannah also isn’t alone when it comes to a major challenge she faces in getting her jowls removed: Cost. The average surgeon fee for an eyelid lift or liposuction procedure is slightly less than $3,000. It’s $6,000 for a tummy tuck. And, in cities including New York, those numbers easily can be doubled.

Since elective cosmetic surgery isn’t covered by insurance, Hannah and millions of other women have to pay for it “out of pocket.” Hannah’s got a multitude of other expenses these days, not the least of which is her son’s college tuition and a wedding next year for her daughter.

She sure would like to have her jowls gone by the wedding, but she doesn’t want to dip into her retirement savings or put the expense on her credit card, where she’s going to end up paying a small fortune in interest.

She needn’t do either.

What Hannah doesn’t know, but would be delighted to hear, is that she can finance her plastic surgery at a low fixed interest rate, and pay off the loan agreement from her income. This will allow her to keep her assets intact and avoid using high-interest credit cards.

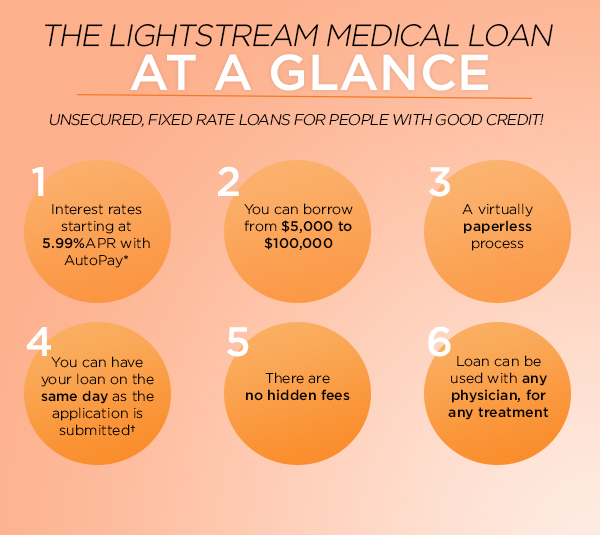

As a matter of fact, LightStream is offering qualified customers unsecured medical loans at rates starting as low as 5.99% APR with AutoPay.*

LightStream doesn’t require you to complete complex paperwork for its approval process, and you don’t have to secure collateral as with other types of loans. Plus, if you have good-to-excellent credit, you can apply online for a medical loan in the morning and have the money in your checking account as soon as that same afternoon. (As you’ll see below!)

LightStream doesn’t require you to complete complex paperwork for its approval process, and you don’t have to secure collateral as with other types of loans. Plus, if you have good-to-excellent credit, you can apply online for a medical loan in the morning and have the money in your checking account as soon as that same afternoon. (As you’ll see below!)

FOF spoke with Julie Olian, vice president at LightStream, to learn more about its medical financing, so we can have cosmetic surgical treatments, without having nightmares about bills.

HOW HIGH DO YOUR MEDICAL LOAN INTEREST RATES GO, AND WHAT DETERMINES THE RATE?

Though rates can change, our current fixed rates for medical financing start at 5.99% APR with AutoPay, depending on the size of the loan; the length of time for which it’s taken; and the borrower’s unique financial position. We look at every applicant individually. We offer fixed, competitive rates for up to 84 months.

HOW MUCH CAN I BORROW FOR THE TREATMENT?

You can borrow from $5,000 to $100,000.

LIGHTSTREAM PROVIDES UNSECURED PERSONAL LOANS. WHY DON’T YOU REQUIRE ANY COLLATERAL?

We lend to people because they have shown that they manage their finances  responsibly. You might have a car that you’ve paid off; are up to date on your mortgage payments; don’t have a lot of credit card debt, and aren’t under water with things such as college loans. You’ve demonstrated, over time, that if you take out a loan, you pay it back.

responsibly. You might have a car that you’ve paid off; are up to date on your mortgage payments; don’t have a lot of credit card debt, and aren’t under water with things such as college loans. You’ve demonstrated, over time, that if you take out a loan, you pay it back.

We believe that if you’ve managed your finances well, you deserve a better loan experience.

ARE THERE ANY ‘HIDDEN’ FEES?

LightStream does not charge fees. Period. What you see is what you get. We don’t charge to apply nor do we add points (a percentage of the loan amount that’s tacked on to the loan itself), closing costs or account servicing charges. Also, the interest rate on your loan is fixed (and highly competitive!), so it won’t go up over time.

PLEASE SUMMARIZE THE PROCESS FOR GETTING MEDICAL FINANCING.

Simply fill out and submit a brief application that you’ll find online at LightStream.com. During business hours, we’ll review your credit, savings and assets, and get back to you quickly. If you’re approved, you’ll receive an email, detailing a few short steps necessary to e-sign your loan agreement, set up monthly billing and choose a funding date to activate your loan. If you complete the application and documentation before 2:30 PM (Eastern Time), you can have the money deposited in your bank account as soon as the same day. It’s a quick, straightforward process that can be done entirely online. (Although we do have an amazing customer service team that’s available to answer your questions.)

Simply fill out and submit a brief application that you’ll find online at LightStream.com. During business hours, we’ll review your credit, savings and assets, and get back to you quickly. If you’re approved, you’ll receive an email, detailing a few short steps necessary to e-sign your loan agreement, set up monthly billing and choose a funding date to activate your loan. If you complete the application and documentation before 2:30 PM (Eastern Time), you can have the money deposited in your bank account as soon as the same day. It’s a quick, straightforward process that can be done entirely online. (Although we do have an amazing customer service team that’s available to answer your questions.)

Once you receive your funds, you can use the money with any physician, for any procedure or treatment.

HOW DO YOU DETERMINE “GOOD” CREDIT?

You can find answers to this question, and others, on our website, but generally, someone has “good” credit if they have several years of credit history with a variety of accounts types, such as major credit cards, installment debt (a car loan, for example), and mortgage debt (if applicable). They also have few, if any payment delinquencies; have shown an ability to save; and have a sufficient income and assets to pay back current loan obligations, as well as the new loan from LightStream.

ONCE A MEDICAL LOAN IS APPROVED, DO I HAVE TO ACCEPT IT RIGHT AWAY?

No, our offer is good for 30 days.

CLICK HERE FOR MORE INFORMATION AND TO APPLY FOR A LIGHTSTREAM MEDICAL LOAN.

*The APR listed is for an unsecured medical expenses loan between $10,000 and $100,000 with a term between 24 and 36 months, for applicants with excellent credit. Your APR may differ based on loan purpose, amount, term, and your credit profile. Rate is quoted with AutoPay repayment option. Rates under the invoicing option are 0.50% higher. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

Payment example: Monthly payments for a $10,000 loan at 5.99% APR with a term of 3 years would result in 36 monthly payments of $304.17.

† You can fund your loan today if today is a banking business day, your application is approved, and you complete the following steps by 2:30 p.m. Eastern time: (1) review and electronically sign your loan agreement; (2) provide us with your funding preferences and relevant banking information; and (3) complete the final verification process.

0 Responses to “How You Can Afford Plastic Surgery”

Anne-Marie Kovacs says:

Geri, I love your disclosure statement. So you know, I would trust pretty much anything that you recommend. In this case, I love that LightStream found you to share about their service. Without you, I never would have known about this. I’m definitely making notes for near-future reference. Thanks!