Girls, We Are Golden!

by Wendie Pecharsky

Home-sharing a la ‘The Golden Girls’ may soon be the new norm for baby boomer women.

—————————————————————————————————

Two years ago, FOF Marianne Kilkenny of Asheville, North Carolina stumbled upon a whole new model for affordable living…literally. “It was Christmas Day, I was living alone and I fell down the stairs,” she says. “It was a while before somebody found me.”

Luckily, Marianne, who is divorced and has no children, was not too seriously injured, but took her fall as a sign. In 2007, Marianne had founded the Women for Living in Community Network, an organization which provides information on alternative living models for FOFs. After her fall, she decided, “I needed to walk my talk.” She and two other divorced women she knew took the plunge and rented a four-bedroom house together.

US Census data shows that more and more, single FOFs (almost half a million of them, according to a 2010 analysis by AARP) are choosing to live with other women of the same age, similar to the situation that was played out on the ’80s sitcom The Golden Girls.

“It isn’t easy to throw people in their 60s, 70s and 80s together,” Marianne admits. “We’re all bringing with us our families of origin, with all their dysfunction.” But, Marianne says that home-sharing has given her a sense of connectedness that she wouldn’t have found living alone. “There’s someone to leave the porch light on for me when I come home late. It’s heartwarming.” Plus, Marianne says, without home-sharing, she could never have afforded to live where she does.

Marianne was fortunate to know her housemates before they all moved in together, but many FOFs have had to rely on their own resourcefulness to find others like themselves.

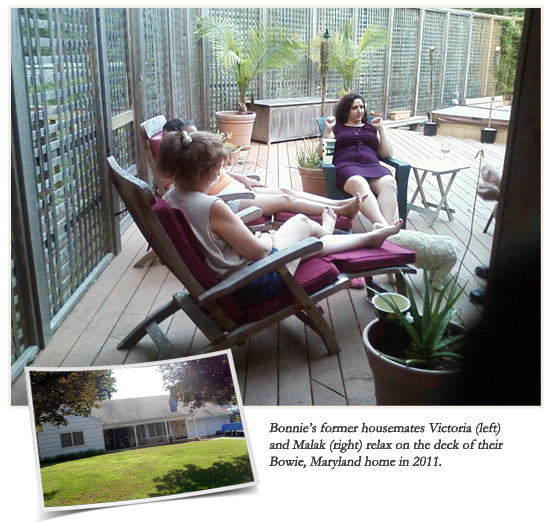

Bonnie Moore, 67, of Bowie, Maryland, is one of those women. “I had invested a lot of money in my house, and didn’t want to lose it,” says Bonnie, of her five-bedroom manse. But after her divorce, she needed help paying the mortgage. She scoured Craigslist to find four housemates, and after a few mismatches, she finally hit upon the right mix. Now, the five women operate like one big happy family. “Women need companions, and when I walk in the door in the evening, there’s someone there to ask me, ‘How was your day?’”

In fact, Bonnie is so pleased with how her living arrangement came together that she has decided to make a profession out of matching FOF home providers with home seekers. In March of this year, she created the website GoldenGirlsNetwork.org, which she hopes will one day evolve into a nationwide network of shared-housing opportunities.

Like the fictional “Golden Girls,” Linda Williams, 65, fled the icy Philadelphia winters to live with her friend, Marsha, in a Sarasota, Florida, over-55 community. But unlike her TV counterparts, Linda, who is divorced, only shares the condo from January to April, when her housemate comes to stay. The rest of the year, she has the place all to herself. But, Linda couldn’t have made the move without the financial support of her friend. “To stay for the season is expensive,” says Linda “My friend suggested we pool our money.” It all worked out for the best: “It’s nice to have the company when she’s down here,” Linda says. “We have fun together, and I am living in a beautiful place that I couldn’t have swung on my own.”

However, Linda stresses the fact that just because two people are friends doesn’t mean they can live together. “You really need to talk and find out each other’s preferences down to the last detail,” says Linda. “Before you move in, take a trip or spend some time working on a project together, and see how it goes. And most important, remain flexible,” she says. “If you can’t be conscious, caring and direct, there’s going to be a problem.”

Marianne agrees: “You can’t go into this kind of living arrangement blind,” she says. “You have to figure out why you are doing it and what you want to get out of it. Is it strictly for financial reasons or do you want to have a family connection? For me, it was about forming relationships and personal growth. If you don’t want that, I don’t recommend shared housing.”

Other issues to consider, according to Bonnie, include privacy and personal preferences, such as smoking or pet preferences. “It’s vital to have extensive discussions about these issues.” Linda and her housemate, who’s also divorced, even hammered out a protocol with regard to dating. “We don’t bring men back to the apartment,” she says with a laugh. “We go to a hotel,” she adds, “It’s just as simple as that.”

Though at times it can seem daunting to reinvent oneself, FOFs have proven they are up to the task. “This continues to be my time and I want to live it my way,” says Marianne. Amen to that.

—