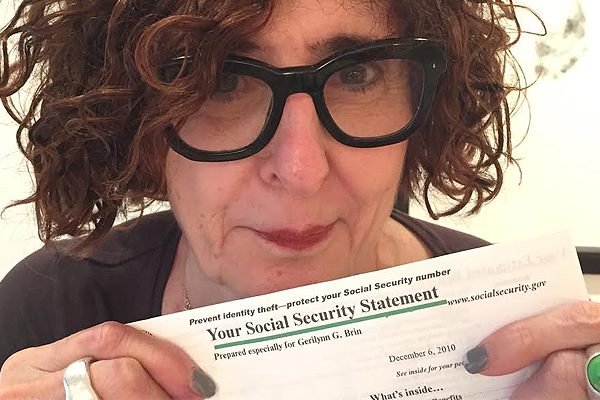

Last month, I told you about a new seminar called Preparing for Retirement, and how it covers the three essential keys you should consider to create a comfortable retirement for yourself, including how to maximize your social security.

You may be surprised to know that you’ll need to make a number of decisions that will affect the amount of your benefit, when it comes time to collect.

First, when is the best time to collect Social Security benefits?

I always assumed I would file and start collecting as soon as I was able— when I turned 62. But, did you know that if you file then, you’ll get only 75% of what you’ll get if you wait until your full retirement age (which is 66 for those born between 1943 and 1954)?

And, if you wait even longer, your benefit rises 8% per year until you turn 70 years old.

Good to know, but that doesn’t necessarily mean it’s best to wait. It’s not that cut and dry. There’s so much more to consider, because your personal circumstances are what should ultimately drive your decision. While there can be a big difference in how much you’ll collect, depending on how old you are when you file, personal factors outweigh the math every single time.

What do you need to consider if you’re married?

The answer? Everything! That’s because your strategy should take into account when and how your spouse files for benefits as well, in order to maximize YOUR benefits.

A strategy? Yes, an optimization strategy — and here are three to consider:

• File and Suspend

• Restricted Application

• A combination of both

You probably have no idea what these strategies involve, but you’ll find out how they work at Preparing for Retirement seminar. And, you’ll get examples of each.

The bottom line: Failing to understand how your and your spouse’s benefits interact with each other can end up costing you thousands of dollars in income.

By the way, if you’re divorced, you have the same rights to spousal benefits that you would if you were still married — as long as you were married for 10+ years, are divorced for two or more years, still unmarried, and your ex is eligible and at least 62.

Social Security is an important part of your overall retirement strategy

It’s crucial to make an informed decision. You’ve got to know how Social Security works in order to make it work for you.

Again, the seminar is called Preparing for Retirement — it’s fun, informative and only $15 per person or $25 per couple. It’s presented by Edelman Financial Services and each attendee will receive a free copy of the national bestseller,1The Truth about Retirement Plans and IRAs by Ric Edelman.

1 The Washington Post, Washington Bestsellers Paperback Nonfiction/General. April 20, 2014.Ric Edelman, Chairman and CEO of Edelman Financial Services LLC, a Registered Investment Advisor, is an Investment Advisor Representative who offers advisory services through EFS and is a Registered Principal of and offers securities through SMH. Advisory Services offered through Edelman Financial Services LLC. Securities offered through Sanders Morris Harris Inc., an affiliated broker/dealer, member FINRA/SIPC.

This post is sponsored by Edelman Financial Services. Thank you for supporting FabOverFifty!

0 Responses to “Understanding Social Security Benefits”

Corinne Garrett says:

This is a great article: just to be in the know to research or ask, even if you dont’ take the seminar is good counsel!