AgeUp compensated FOF to write this sponsored post. Regardless, we recommend only products or services that we believe will be helpful for our readers. All insights and expressed opinions are our own. —Geri Brin

My friend Linda plans to sell her New York co-op and move to a community living residence, but she’s worried her nest egg won’t last if she lives well into her 90s. Now 87 years old, Linda wishes the new AgeUp product had been available years ago to give her a supplemental income if she’s fortunate to live as long as her mom. “I’ve been independent my whole life, and I don’t want to turn to my daughter to help support me,” she said.

Available to any of us between 50 and 75 years old, AgeUp converts small monthly payments into greater – and guaranteed – monthly payouts once we reach a selected age between 91 and 100. Your monthly payment can be as low as $25, which makes AgeUp financially accessible.

Available to any of us between 50 and 75 years old, AgeUp converts small monthly payments into greater – and guaranteed – monthly payouts once we reach a selected age between 91 and 100. Your monthly payment can be as low as $25, which makes AgeUp financially accessible.

Think about it this way: Life insurance is based on the small probability that someone will die prematurely, and can help prevent the family left behind from becoming financially strapped. AgeUp addresses the other extreme, providing income when you live much longer than expected. These additional funds can help enable a higher quality of life and greater financial freedom – something that all of us desire in our later years.

Consider that one out of every three Baby Boomers who are now 65 years old will live until at least age 90, and one out of seven will live until age 95, according to the Social Security Administration. While AgeUp is available to men and women, women would benefit the most as we’re more likely to live longer. AgeUp will help make sure we’re financially prepared so we can enjoy those extra years comfortably.

And how nice to be able to relieve our adult children of a possible burden. According to a survey conducted by AgeUp, a whopping 68 percent of millennials expect to provide financial contributions to their parents should they outlive their retirement savings. That means us! By planning for extended longevity now, we can set ourselves up to live the lifestyle that we want once we reach our 90s and beyond – one where we have our own resources and aren’t dependent on our children or family members for financial support.

And how nice to be able to relieve our adult children of a possible burden. According to a survey conducted by AgeUp, a whopping 68 percent of millennials expect to provide financial contributions to their parents should they outlive their retirement savings. That means us! By planning for extended longevity now, we can set ourselves up to live the lifestyle that we want once we reach our 90s and beyond – one where we have our own resources and aren’t dependent on our children or family members for financial support.

“We created AgeUp for physically healthy people in their 50s to early 70s who have longevity in their families and have a reasonable chance of living very, very long lives,” said Blair Baldwin, general manager. “My grandparents were financially comfortable, but my grandfather and grandmother needed years of in-home care in their later years, which can get quite expensive.” A product like AgeUp can help offset some of these costs, providing a recipient with a guaranteed income stream that lasts for the rest of her lifetime, plus the flexibility to spend the money as she chooses, with no restrictions or claims to file.

HOW AGEUP WORKS

➩ First, you choose your monthly payment, which can be as low as $25 and as high as $250 a month. “Lots of people are choosing the $250 option, many more than I would have suspected,” Baldwin told me.

➩ Second, you decide when you want your payouts to begin – called the “payout” age – and whether or not you want your money returned to your beneficiaries if you die before the payout age.

Choosing “yes” guarantees that you’ll get back at least what you put in, no matter what. If you die before your target payout age, 100% of the premiums you’ve paid to that point will be returned to your beneficiary. However, your payouts will be smaller if you do reach your target payout age.

Choosing “yes” guarantees that you’ll get back at least what you put in, no matter what. If you die before your target payout age, 100% of the premiums you’ve paid to that point will be returned to your beneficiary. However, your payouts will be smaller if you do reach your target payout age.

If you choose “no” for the “death before payout age” option, there’s no return if you die before payouts begin. There’s a chance you could lose your premium payments, but your payouts will be larger if you live to your target payout age.

If you reach the payout age but pass away shortly thereafter, your money will be returned to a beneficiary until they receive the total amount that you had contributed.

➩ You can start, stop or change the amount you pay at any time.

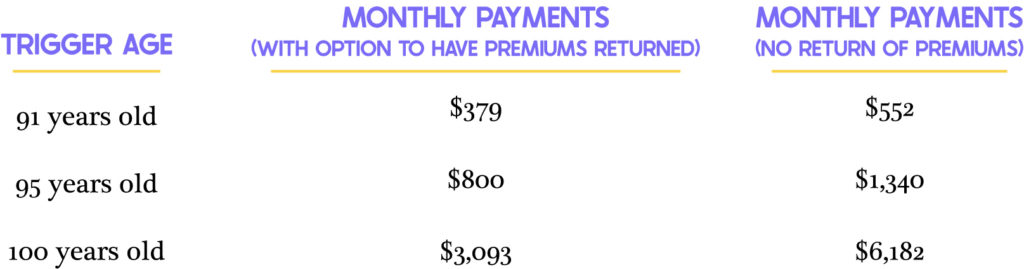

Here’s an example1 of what a 55-year-old woman could receive at different payout ages if she makes payments of $25 per month:

Unlike long term care insurance, which is really expensive, can have a coverage limit, and must be spent on medical costs, AgeUp is a low cost product with unrestricted use. You can use your monthly payouts however you choose, helping you to enjoy the financial autonomy that you’re accustomed to in your later years.

“Our goal is to give you the most bang for your buck,” Baldwin stressed.

IS AGEUP RIGHT FOR YOU?

To determine your own estimated monthly payouts based on your current age, gender, monthly payments, payout age and return of premiums, visit the AgeUp website and click “Get an estimate.” From here, you’ll answer a few questions and then use the AgeUp calculator to adjust your monthly payments, payout age, and return of premium option.

To determine your own estimated monthly payouts based on your current age, gender, monthly payments, payout age and return of premiums, visit the AgeUp website and click “Get an estimate.” From here, you’ll answer a few questions and then use the AgeUp calculator to adjust your monthly payments, payout age, and return of premium option.

Should you have questions or need assistance, AgeUp offers customer support via online chat or email, or you can schedule a call to speak with a team member. There’s also a robust FAQ page and a detailed product snapshot available on the AgeUp website.

We don’t know what the future holds, but AgeUp can provide peace of mind if you think that you may live an exceptionally long life and will need additional financial resources to lead the lifestyle that you want. Here’s to you and your longevity!

Sponsorship Disclosure

AgeUp is issued and backed by MassMutual, and sold by Haven Life Insurance Agency, a MassMutual-owned innovation hub. MassMutual has been in business since 1851 and is rated A++ for financial strength by A.M. Best2. For additional information, visit our website or check out our frequently asked questions.

AgeUp is a Deferred Income Annuity (ICC19DTCDIA) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111 and offered exclusively through Haven Life Insurance Agency, LLC. Contract and rider form numbers and features may vary by state and may not be available in all states. Our Agency license number in Arkansas is 100139527.

![]()