This is a “sponsored post.” LightStream compensated FOF with an advertising

sponsorship to write it, and provides more information at www.lightstream.com/wedding-loan.

Regardless, I only recommend products or services I believe will be helpful for my readers.

All insights and expressed opinions are my own. —Geri Brin

Catherine’s 29-year-old daughter, Karli, recently became engaged to a darling young man with a promising career as an accountant, and there’s nothing more Catherine would like to do for her than make a memorable wedding. But she figures the celebration is going to cost in the neighborhood of $20,000, in their hometown of Des Moines, which means she will have to dip into her 401K to help pay the wedding expenses.

“I’ve got the money but I’d rather not go into

my retirement account, which is earning good interest. I’d also have to pay income taxes on what I withdraw,” Catherine pondered.

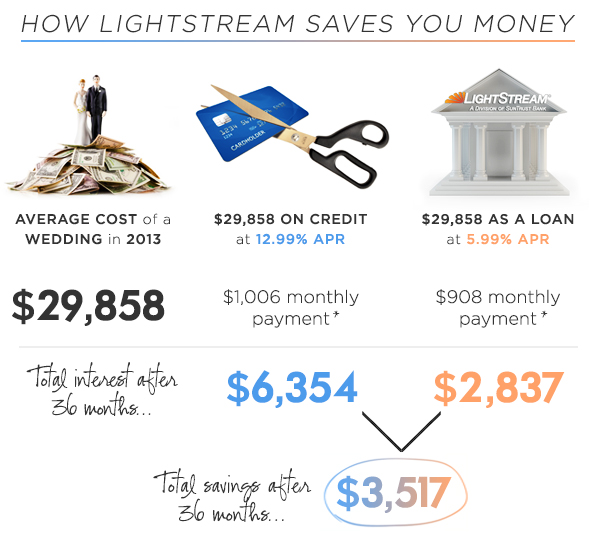

Although we all know a wedding doesn’t have to cost $20,000, Catherine’s estimate isn’t too far off the mark. The national average spent on a wedding in 2013, excluding the honeymoon, was $29,858, according to the annual Real Weddings Survey by theknot.com, which polled 13,000 U.S. brides and grooms. Even in Utah and Idaho, which had the lowest average spends in 2013, weddings cost $16,816 and $16,169 respectively. (The average was $86,918 in New York City!)

What Catherine doesn’t know, but should be delighted to hear, is that she can possibly finance Karli’s wedding at a fixed interest rate as low as 5.99%APR with autopay, and pay off the loan agreement from her and her husband’s income. This will allow her to keep her high performing assets intact (where she’s been earning well over 6% annually) and avoid using credit cards to pay for wedding expenses.

LightStream, an online lending division of SunTrust Bank, started loaning money for weddings about two years ago. Its approval process doesn’t involve complex paperwork, and you don’t have to secure collateral as with other types of loans. As a matter of fact, if you have good-to-excellent credit, you can apply online for a wedding loan in the morning and have the money in your checking account as soon as that same afternoon. (As you’ll see below!) Catherine can pay the florist’s and caterer’s deposits on the double.

FOF spoke with Julie Olian, vice president at LightStream, to learn more about its wedding financing, so FOFs, like Catherine, can give their wonderful daughters dream weddings, without having nightmares about bills.

FOF: Do you have any advice on how to decide how much you should spend on a wedding?

LIGHTSTREAM: We would never encourage you to spend more than you can afford, on anything. But we believe that anyone who has good-to-excellent credit, proven over the years, is smart with her money and really knows how to manage her finances. LightStream is a great financing option for those who don’t want to liquidate high-performing assets.

How high do your wedding loan interest rates go, and what determines the rate?

Though rates can change, our current fixed rates for wedding financing (with autopay) start at 5.99%APR and go up to 9.99%APR, depending on the size of the loan; the length of time for which it’s taken; and the borrower’s unique financial position. We look at every applicant individually.

How much can I borrow for a wedding?

You can borrow from $5,000 to $100,000.

*All dollars rounded

We’ve never heard of wedding loans before. Do banks give them, too?

We’re part of SunTrust Bank, and we do. However, getting a loan from other lenders for something like a wedding could be a cumbersome process, if they’d even do it at all. Many lenders don’t finance many of the loan purposes that LightStream does.

LightStream provides unsecured personal loans. Why don’t you require any collateral?

We lend to people because they have shown that they manage their finances responsibly. You might have a car that you’ve paid off; are up to date on your mortgage payments; don’t have a lot of credit card debt, and aren’t under water with things such as college loans. You’ve demonstrated, over time, that if you take out a loan, you pay it back.

We believe that if

you have managed your finances well, you deserve a better loan experience.

Are there any ‘hidden’ fees?

LightStream does not charge fees. Period. What you see is what you get. We don’t charge to apply nor do we add points (a percentage of the loan amount that’s tacked on to the loan itself), closing costs or account servicing charges. Also, the interest rate on your loan is fixed (and highly competitive!), so it won’t go up over time.

Please summarize the process for getting wedding financing.

Simply fill out and submit a brief application that you’ll find online at LightStream.com. During business hours, we’ll review your credit, savings and assets, and get back to you quickly. If you’re approved, you’ll receive an email, detailing a few short steps necessary to e-sign your loan agreement, set up monthly billing and choose a funding date to activate your loan. If you complete the application and documentation before 2:30 PM (Eastern Time), you can have the money deposited in your bank account as soon as the same day. It’s a quick, straightforward process that can be done entirely online. (Although we do have an amazing customer service team that’s available to answer your questions.)

Once you receive your funds, you can use the money with any vendor, for any service or product you choose. The venue, florist, catering, music, travel, wardrobe or any other cost associated with the wedding can be paid for with your LightStream loan.

How do you determine “good” credit?

You can find answers to this question, and others, on our website, but generally, someone has “good” credit if they have several years of credit history with a variety of accounts types, such as major credit cards, installment debt (a car loan, for example), and mortgage debt (if applicable). They also have few,  if any payment delinquencies; have shown an ability to save; and have a sufficient income and assets to pay back current loan obligations, as well as the new loan from LightStream.

if any payment delinquencies; have shown an ability to save; and have a sufficient income and assets to pay back current loan obligations, as well as the new loan from LightStream.

Once a wedding loan is approved, do I have to accept it right away?

No, our offer is good for 30 days.