FOFrugal?! Kathy Spencer, author of “How to Shop for Free,” lives off a yearly income of $45,000, feeding her family of six on just $4 dollars per week. (You read that right!) She saves an estimated $60,000 per year with her tried and true couponing tricks. Here, she shares some of her best saving secrets, including the hardest item to get for free (and how she succeeded at getting it), how to become “rich at the drugstore,” and ways to cut down your weekly grocery bill.

FOFrugal?! Kathy Spencer, author of “How to Shop for Free,” lives off a yearly income of $45,000, feeding her family of six on just $4 dollars per week. (You read that right!) She saves an estimated $60,000 per year with her tried and true couponing tricks. Here, she shares some of her best saving secrets, including the hardest item to get for free (and how she succeeded at getting it), how to become “rich at the drugstore,” and ways to cut down your weekly grocery bill.

Enter to win a copy of Kathy’s book, “How to Shop for Free,” by answering this question in the comments below: what was the best thing you ever got for free (or almost free?)

—————————————————————————————————

Where can someone find the best coupons?

Coupon inserts. Before the truck comes to pick up the unsold papers at your local gas station or convenience store, ask if you can take the inserts. Put a donation box for coupons at a local church.

What online resources can you recommend for coupons?

Coupons.com, and SmartSource.com. You can print coupons off [those] websites.

Do you have a system for organizing all of your coupons?

On my website I have something called the Coupon Database, so if you wanted to know if there was a coupon for Crest toothpaste, [you can search ‘toothpaste’] and it would pull up all the inserts that came out with coupons for toothpaste. I cut the coupons from the insert and organize them by date in my file cabinet. For my coupons [that I’m ready to use,] I have a little [ziploc] baggy for every store I go to. Those bags go in my purse, so that if I’m driving around I have my coupons and am ready to go.

Can you offer some couponing tips for once you have your coupons organized and ready to go?

- 1) Be patient. I didn’t get my spending down to 4 dollars a week [right away]. I started challenging myself. The best thing to do is to start tracking how much you save [each week.]

- 2) Set a realistic goal. Go over your receipts to find out what you really are spending each week. Then give yourself a goal. If you’re spending 300 dollars a week at the grocery store, take a baby step and [aim for] 5-10% off of that, so it’s not so scary and drastic, it’s doable.

- 3) Only take cash to the store. That way you don’t make spontaneous purchases.

- 4) Track it all. As long as you’re keeping a chart [with your savings], you’re going to feel empowered. You did it this week, you’ve got [extra] money in your pocket.

- 5) Always stick to your list. Once you have that list, you’re going to be in and out of the grocery store quicker than ever.

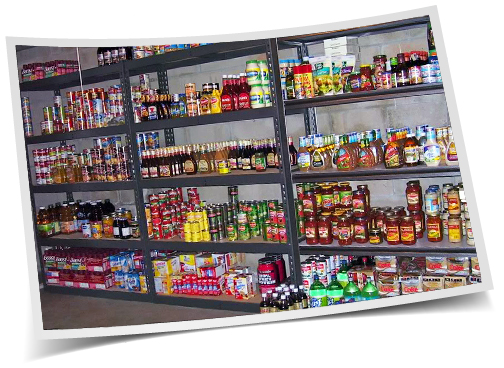

- 6) Get as many free things as you can. Any time something is free, get as much of it as you can. Don’t get one or two — you want to buy for a year out. If you don’t have [enough] coupons [for the items that are free], you can [get the coupons] on eBay for a couple of bucks. Your stockpile [of household necessities] will get bigger and bigger, and your list of needs will get smaller and smaller, until you reach your goal budget. As long as you’re focused and determined, anyone can do it.

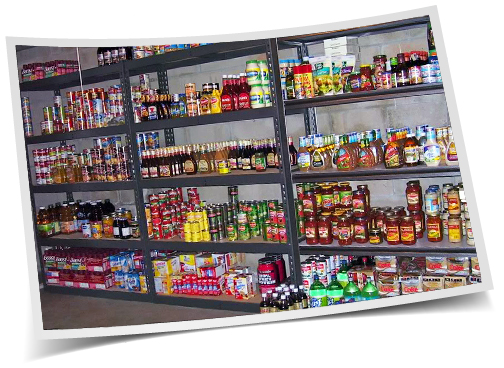

Kathy often showcases the stockpiles of her coupon cutting devotees on her blog.

How do you feel about deal sites like Groupon, or LivingSocial?

I love them! LivingSocial is one of my favorites. Not only is everything discounted, but for every three friends you refer, you get [the deal] for free. I’ll buy it and put it on my website or my Facebook page and say, “look, this is what I got, it’s a great deal!” When three people buy the deal, it makes mine completely free. You can’t get better than that.

Do you use any shopping apps?

My favorite is the barcode scanner. If you’re in a store and you see, let’s say a baby carrier that you want, you can scan the product barcode and it will tell you where in your vicinity it’s for sale.

Can you recommend any deals specifically for FOFs?

If you’re over fifty, you may be [considered] senior citizens, and a lot of stores and restaurants such as Kohl’s and Denny’s offer seniors special savings.

How do you get beauty products for free?

You can get all drugstore items completely free. I get everything at CVS. Take advantage of their Extra Care program. It gives you 2% back (in Extra Care bucks) on all purchases, and $1 of Extra Care bucks for every 2 prescriptions filled. Extra Care bucks are just like monopoly money [you can use them on anything in the store.] You can keep adding coupons on top of that. You can actually become rich at drugstores. I have a member on my website [who shops at] Rite Aid. Whatever she gets, works out completely free, with a rebate and coupons. The Rite Aid rebate turns your coupons into cash. She’s made over $10,000 in free Rite Aid money, which translates to cash once she gets the [rebate] check.

What about clothing?

At Ann Taylor and The Loft, and they have sales that are 40% off, and then they’ll offer different coupons or a savings card that says spend $50 get $25 off. So if a brand new shirt was $50 and then you get 40% off, that brings it to $30, and if you had $25 off $50 that would bring it down to $15. You can stack that coupon there, and also at New York and Company. If you don’t have those savings cards, you can go on Ebay and buy them for a very minimal [amount], maybe $1.

What is the hardest item to get for free?

Heating oil, which I thought was impossible. I’ve actually had two or three free fill-ups so far. There’s a program called Neighbor’s Oil. You go on and you sign up to find out what companies offer the best deal in your neighborhood. It does all of the price shopping for you. There’s no cost to sign up, and for every person you refer, you get a $10 credit. If ten of your friends sign up, that’s $100 in free oil.

Is there anything you can’t get for free?

Everyone asks me that. I say a car, but you can get that through freecar.com, or if you put advertisements on your car. I look at everything like a math problem — there’s always a solution but some of them are easier to figure out. [Free] toothpaste is easy, but things like an in-ground pool, you must challenge yourself. There’s a way to get anything for free if you just think outside the box.

Enter to win a copy of Kathy’s book, “How to Shop for Free,” by answering this question in the comments below: what was the best thing you ever got for free (or almost free?)

—————————————————————————————————

One FOF will win. (See all our past winners, here.) (See official rules, here.) Contest closes July 19th, 2012 at midnight E.S.T.

How to Get a Raise in 47 Seconds, on March 8th, International Women’s Day. Part of a ‘

How to Get a Raise in 47 Seconds, on March 8th, International Women’s Day. Part of a ‘